How Do I Instant Virtual Credit Card ?

How to Obtain an Instant Virtual Credit Card?

In today’s digital age, obtaining an instant virtual credit card can be a swift and secure way to manage your finances online. Here’s a comprehensive guide to help you understand and acquire an instant virtual credit card.

**Step 1: Choose a Provider**

Research and select a reputable financial institution or credit card company that offers virtual credit cards. Consider factors such as fees, accepted merchants, and security features. Foton Card is a reputable and automatic virtual visa card provider.

**Step 2: Apply Online**

Visit the provider’s website and complete the application process. This typically involves filling out personal information and financial details for credit evaluation.

**Step 3: Verification**

Upon submission, you may need to verify your identity through documentation or an online verification process to prevent fraud.

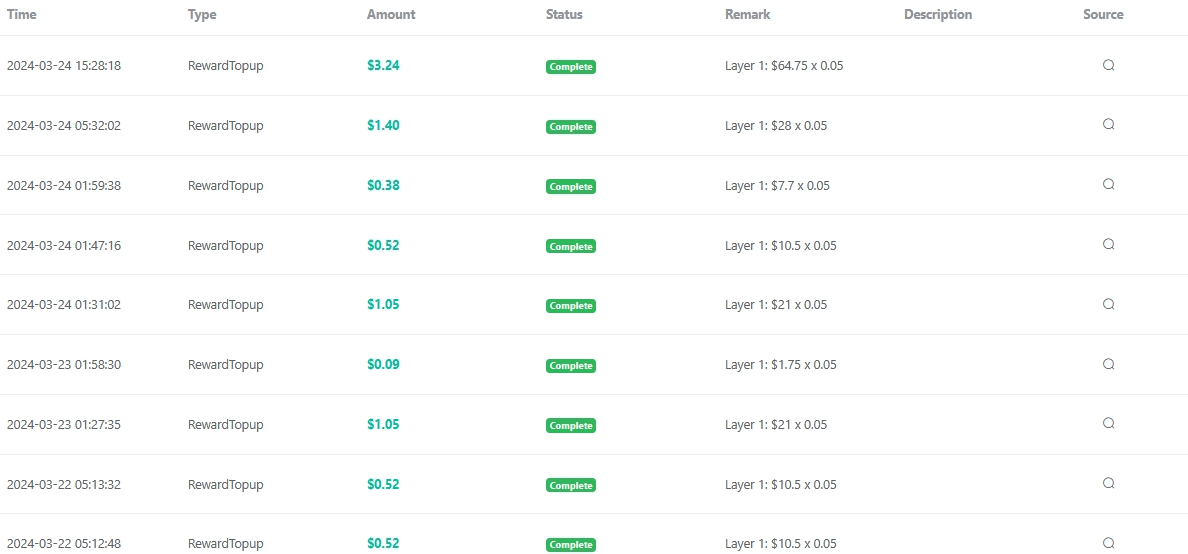

**Step 4: Approval and Card Details**

Once approved, you’ll receive your virtual credit card details, including the card number, expiration date, and CVV code. These can be used immediately for online transactions.

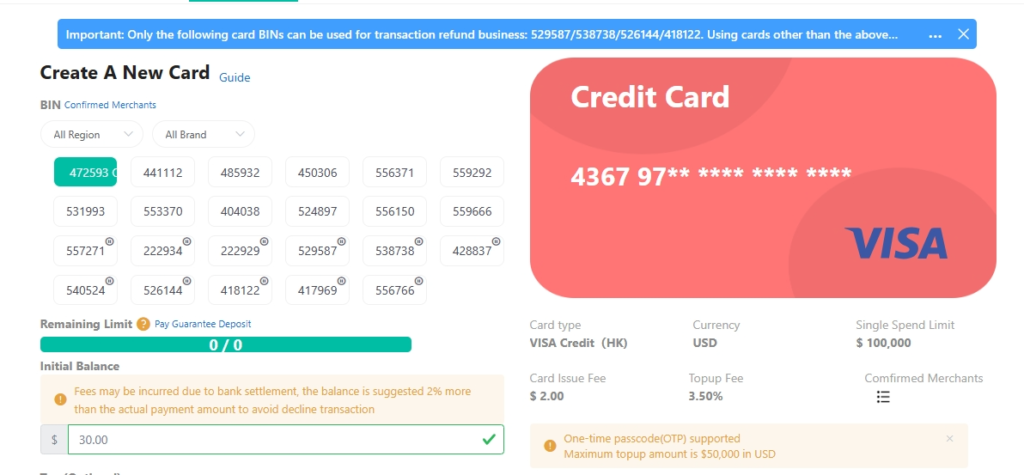

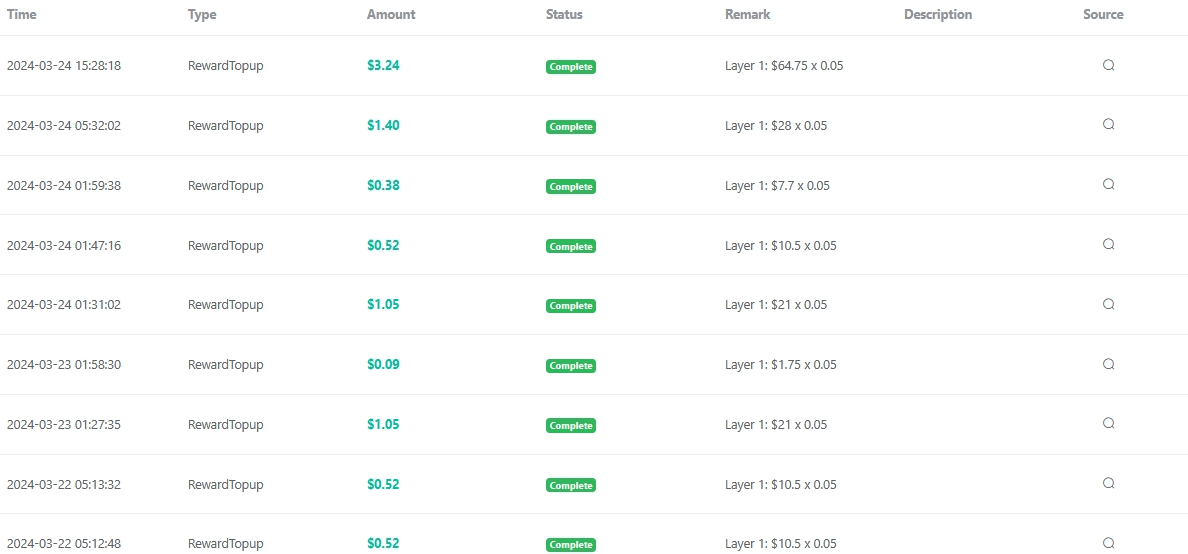

**Step 5: Managing Your Card**

Most providers offer an online portal or mobile app where you can manage your virtual card, view transactions, and set spending limits.

**Benefits of a Virtual Credit Card**

– **Enhanced Security**: Virtual cards often come with one-time use numbers or the ability to lock the card between transactions.

– **Convenience**: Make purchases online without the wait for a physical card.

– **Control**: Set spending limits and track expenses easily.

**Conclusion**

An instant virtual credit card offers a modern solution for secure online shopping. By following these steps, you can enjoy the benefits of digital payments with added security and convenience.

related blogs

What is Foton Card Invitation Code?

How do I register a Foton Card in English?