Benefits of Using a Virtual Visa Card

Enhanced Security: Benefits of Using a Virtual Visa Card

In today’s digital age, online shopping has become increasingly popular. With just a few clicks, you can purchase anything from clothes to electronics, and have it delivered right to your doorstep. However, with the convenience of online shopping comes the risk of credit card fraud and identity theft. This is where virtual visa cards come into play, offering enhanced security and peace of mind for online shoppers.

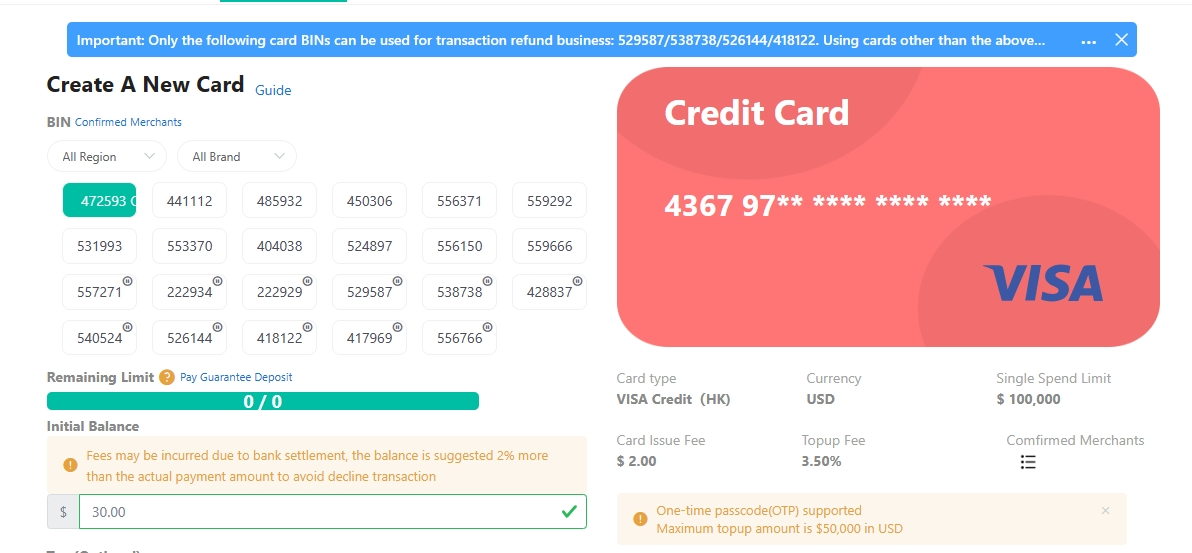

One of the main benefits of using a virtual visa card is the added layer of security it provides. Unlike traditional credit cards, virtual visa cards are not physically issued. Instead, they are generated online and linked to your existing credit card or bank account. This means that your actual credit card information is never shared with the merchant, reducing the risk of it falling into the wrong hands.

Furthermore, virtual visa cards often come with additional security features such as one-time use or limited-use functionality. This means that each time you make a purchase, a unique card number is generated, which can only be used for that specific transaction. Once the transaction is complete, the card number becomes invalid, making it virtually impossible for fraudsters to reuse your card information.

Another advantage of using a virtual visa card is the ability to set spending limits. With traditional credit cards, it can be easy to overspend or fall victim to impulse purchases. However, virtual visa cards allow you to set a specific spending limit, ensuring that you stay within your budget. This can be particularly useful for those who struggle with self-control or want to closely monitor their online spending habits.

Additionally, virtual visa cards offer a convenient solution for those who frequently shop online. With a virtual visa card, you no longer need to manually enter your credit card information every time you make a purchase. Instead, you can simply enter the virtual card details, saving you time and effort. This can be especially beneficial for those who frequently shop on multiple websites or make recurring payments.

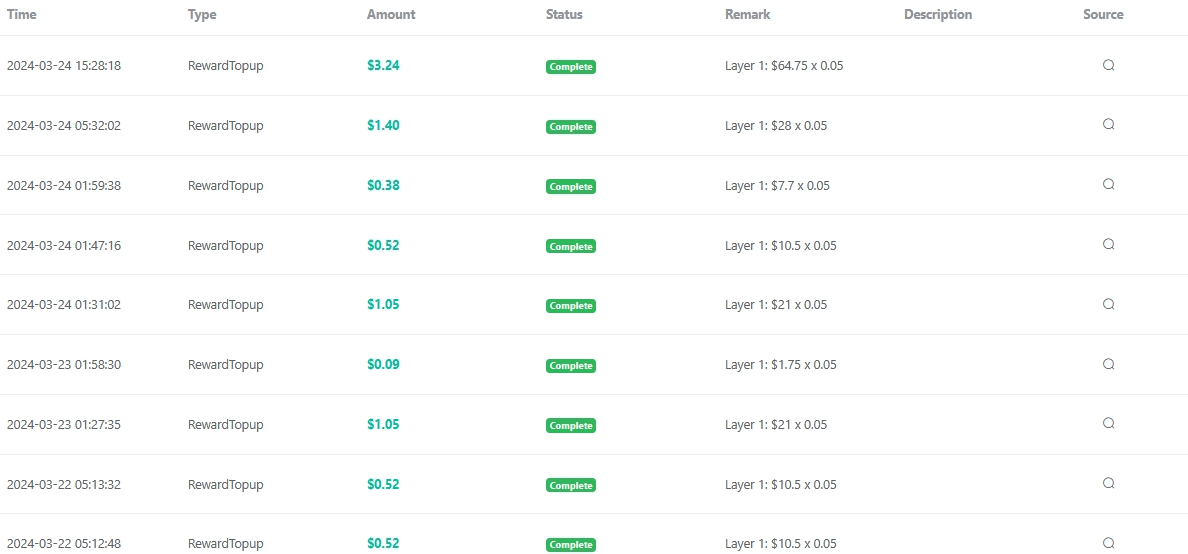

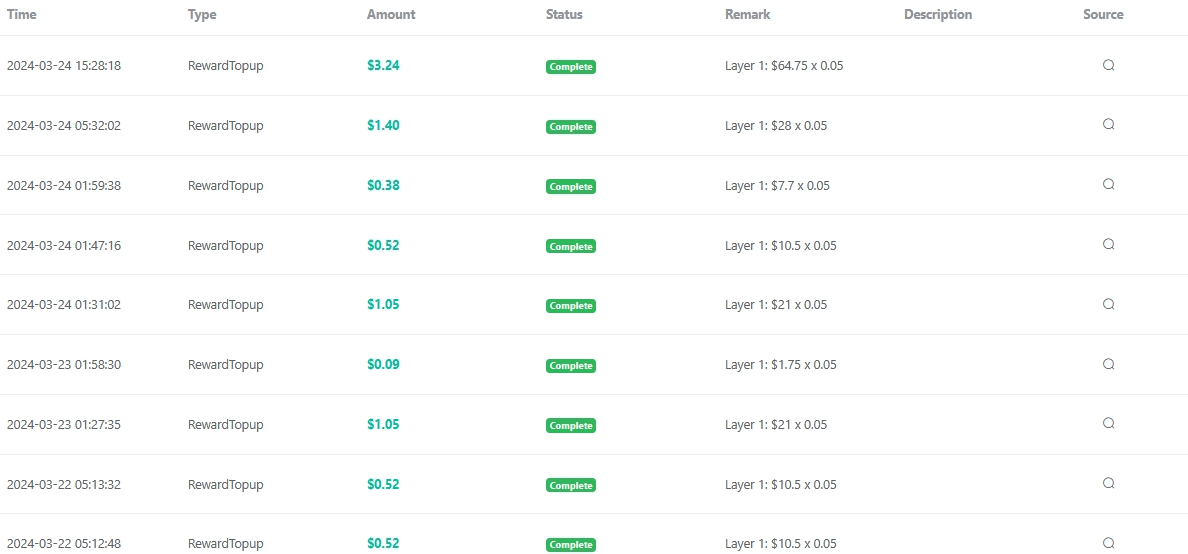

Moreover, virtual visa cards can be easily managed and monitored online. Most virtual card providers offer user-friendly interfaces where you can track your transactions, view your balance, and even freeze or cancel your card if needed. This level of control and transparency allows you to stay on top of your finances and quickly address any suspicious activity.

Lastly, virtual visa cards offer a global solution for online shoppers. With traditional credit cards, you may encounter issues when making purchases from international merchants due to currency conversions or security concerns. However, virtual visa cards are widely accepted and can be used for both domestic and international transactions, making them a versatile option for frequent travelers or those who enjoy shopping from international websites.

In conclusion, the use of virtual visa cards provides enhanced security and peace of mind for online shoppers. With features such as limited-use functionality, spending limits, and easy online management, virtual visa cards offer a convenient and secure solution for those who frequently shop online. By utilizing a virtual visa card, you can protect your credit card information, monitor your spending, and enjoy a worry-free online shopping experience.

Convenience and Flexibility: Exploring the Advantages of Virtual Visa Cards

Why use a virtual visa card? Convenience and flexibility are two key advantages that make virtual visa cards an appealing option for many individuals and businesses. In this article, we will explore these advantages in detail, highlighting the reasons why virtual visa cards have become increasingly popular in recent years.

One of the main reasons why virtual visa cards are so convenient is their accessibility. Unlike traditional physical cards, virtual visa cards can be accessed and used online, making them ideal for online shopping and transactions. With just a few clicks, users can generate a virtual visa card and start using it immediately. This eliminates the need to wait for a physical card to be delivered, saving time and providing instant access to funds.

Furthermore, virtual visa cards offer a high level of flexibility. Users have the ability to set spending limits and expiration dates for each virtual card they generate. This allows for better control over finances and reduces the risk of overspending. Additionally, virtual visa cards can be easily canceled or replaced if lost or stolen, providing added security and peace of mind.

Another advantage of virtual visa cards is their compatibility with various platforms and devices. Whether you are using a computer, smartphone, or tablet, virtual visa cards can be used seamlessly across different devices and operating systems. This versatility ensures that users can make purchases or payments wherever they are, without any limitations or restrictions.

Virtual visa cards also offer enhanced security features compared to traditional physical cards. With the rise of online fraud and identity theft, security has become a top concern for many individuals and businesses. Virtual visa cards address this concern by providing unique card numbers for each transaction. This means that even if a virtual card number is compromised, it cannot be used for any other transactions, minimizing the risk of unauthorized charges.

Furthermore, virtual visa cards do not require users to share their personal or financial information with merchants. This adds an extra layer of protection against potential data breaches or hacking attempts. By keeping personal information private, virtual visa cards help users maintain their privacy and reduce the risk of identity theft.

In addition to these advantages, virtual visa cards also offer a range of additional features and benefits. Some virtual card providers offer rewards programs, allowing users to earn points or cashback on their purchases. Others offer expense management tools, making it easier to track and categorize expenses. These features can be particularly beneficial for businesses, helping them streamline their financial processes and save time and money.

In conclusion, virtual visa cards offer convenience and flexibility that traditional physical cards cannot match. With their accessibility, compatibility, and enhanced security features, virtual visa cards have become a popular choice for individuals and businesses alike. Whether you are looking for a secure and convenient way to shop online or manage your business expenses, virtual visa cards provide a reliable and efficient solution.

Cost-Effectiveness: How Virtual Visa Cards Can Save You Money

In today’s digital age, virtual visa cards have become increasingly popular as a convenient and cost-effective payment solution. These virtual cards offer a range of benefits, including enhanced security, ease of use, and the ability to save money. In this article, we will explore the cost-effectiveness of virtual visa cards and how they can help you save money.

One of the primary reasons why virtual visa cards are cost-effective is because they eliminate the need for physical cards. Traditional credit and debit cards often come with annual fees, maintenance charges, and even foreign transaction fees. With virtual visa cards, these costs are significantly reduced or eliminated altogether. This means that you can save money by avoiding unnecessary fees and charges associated with physical cards.

Furthermore, virtual visa cards can also help you save money by offering competitive exchange rates. When making international transactions, traditional cards often charge high currency conversion fees. However, virtual visa cards typically offer more favorable exchange rates, allowing you to save money on foreign transactions. This can be particularly beneficial for frequent travelers or individuals who frequently make purchases from international merchants.

Another cost-saving advantage of virtual visa cards is their ability to help you stick to a budget. Many virtual card providers offer features that allow you to set spending limits and track your expenses in real-time. By having a clear overview of your spending, you can better manage your finances and avoid overspending. This can ultimately lead to significant savings over time.

Additionally, virtual visa cards can also protect you from fraudulent activities and unauthorized transactions. Traditional cards are susceptible to theft, skimming, and other forms of fraud. However, virtual visa cards provide an added layer of security through features such as one-time-use card numbers and transaction alerts. By minimizing the risk of fraud, you can avoid potential financial losses and save money in the long run.

Furthermore, virtual visa cards can also help you save money by offering exclusive discounts and rewards. Many virtual card providers partner with various merchants to offer cashback, discounts, or loyalty points on purchases made with their virtual cards. By taking advantage of these offers, you can save money on your everyday expenses and even earn rewards for your spending.

In conclusion, virtual visa cards offer a range of cost-saving benefits that make them an attractive payment solution. By eliminating physical card fees, offering competitive exchange rates, helping you stick to a budget, and providing enhanced security, virtual visa cards can help you save money in various ways. Additionally, the exclusive discounts and rewards offered by virtual card providers further contribute to their cost-effectiveness. Whether you are a frequent traveler, an online shopper, or simply looking for a more convenient and cost-effective payment method, virtual visa cards are worth considering.

related blogs

How Do I Instant Virtual Credit Card ?

What is Foton Card Invitation Code?