Maximizing Savings with a Virtual Visa Card

Top 5 Tips for Maximizing Savings with a Virtual Visa Card

How to Shop Economically with Virtual Visa Card

In today’s digital age, online shopping has become increasingly popular. With just a few clicks, you can have your desired items delivered right to your doorstep. However, shopping online can sometimes be expensive, especially if you’re not careful with your spending. That’s where a virtual Visa card comes in handy. It allows you to shop economically and maximize your savings. Here are the top 5 tips for making the most of your virtual Visa card.

Firstly, take advantage of cashback offers. Many virtual Visa card providers offer cashback rewards for using their card. This means that every time you make a purchase, a certain percentage of the amount spent will be credited back to your card. By using your virtual Visa card for all your online purchases, you can accumulate significant cashback over time. This is a great way to save money and get some extra value from your shopping.

Secondly, look for exclusive discounts and deals. Virtual Visa card providers often partner with various online retailers to offer exclusive discounts and deals to their cardholders. These discounts can range from a percentage off the total purchase price to free shipping or even additional rewards points. By keeping an eye out for these exclusive offers, you can save a substantial amount of money on your online shopping.

Thirdly, compare prices before making a purchase. One of the advantages of online shopping is the ability to easily compare prices from different retailers. Before making a purchase, take the time to browse through different websites and compare prices for the same item. By doing so, you can ensure that you’re getting the best possible deal and avoid overpaying for a product. Remember, even a small price difference can add up to significant savings over time.

Fourthly, set a budget and stick to it. It’s easy to get carried away when shopping online, especially with the convenience of a virtual Visa card. However, it’s important to set a budget and stick to it to avoid overspending. Before making any purchases, determine how much you’re willing to spend and prioritize your needs. This will help you make more informed decisions and prevent impulse buying. By staying within your budget, you can shop economically and avoid unnecessary debt.

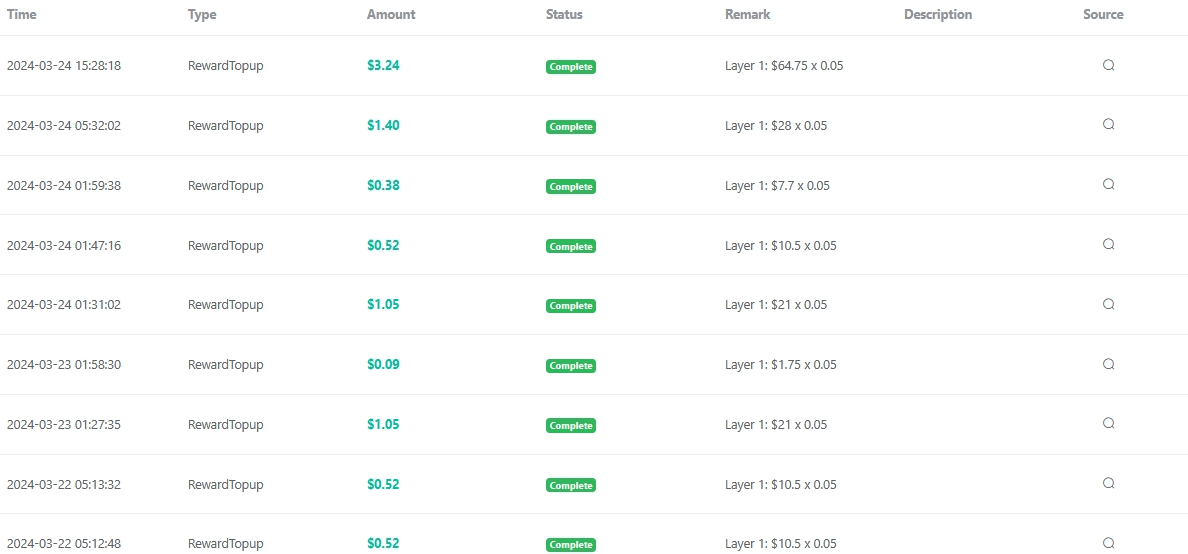

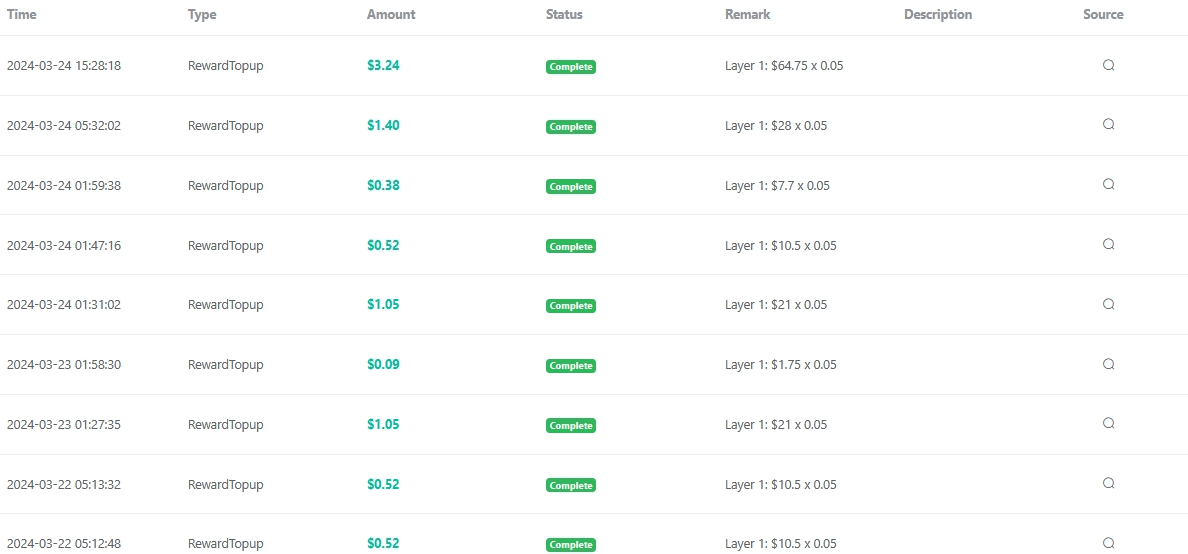

Lastly, keep track of your expenses. It’s essential to keep track of your online shopping expenses to ensure that you’re staying within your budget and maximizing your savings. Most virtual Visa card providers offer online account management tools that allow you to monitor your spending. Take advantage of these tools to track your expenses, categorize your purchases, and identify areas where you can cut back. By being aware of your spending habits, you can make adjustments and shop more economically in the future.

In conclusion, shopping online with a virtual Visa card can be a great way to save money and shop economically. By taking advantage of cashback offers, exclusive discounts, and comparing prices, you can maximize your savings. Additionally, setting a budget and keeping track of your expenses will help you stay within your means and avoid overspending. With these top 5 tips, you’ll be well on your way to becoming a savvy online shopper and making the most of your virtual Visa card.

The Benefits of Using a Virtual Visa Card for Budget-Friendly Shopping

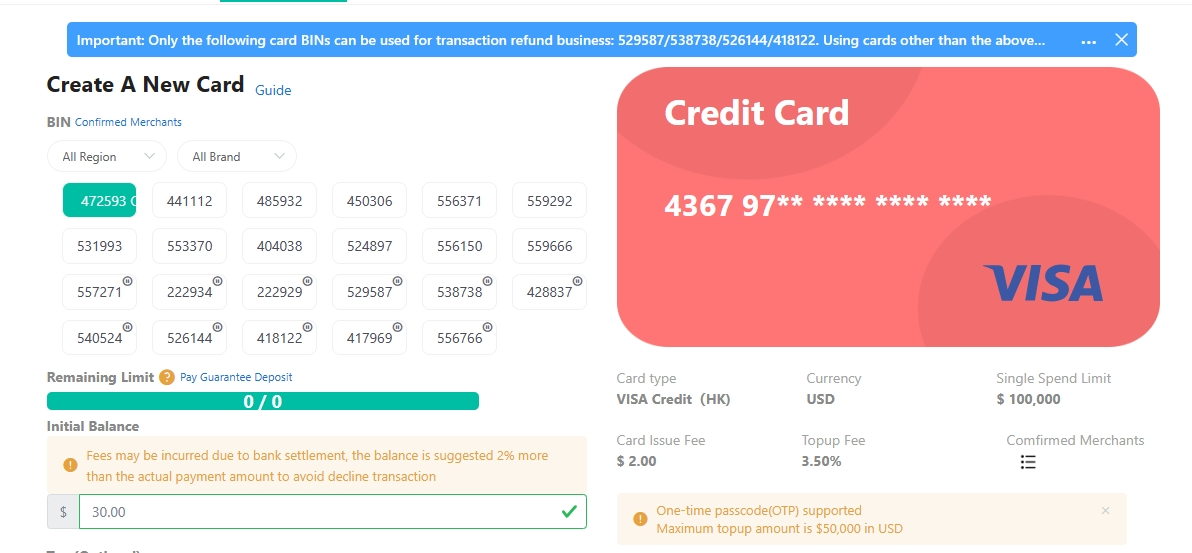

How to Issue a Virtual Visa Card

In today’s fast-paced world, online shopping has become increasingly popular. With just a few clicks, you can have your desired items delivered right to your doorstep. However, shopping online can sometimes be a daunting task, especially when you’re on a tight budget. That’s where a virtual Visa card can come in handy. In this article, we will explore the benefits of using a virtual Visa card for budget-friendly shopping.

One of the primary advantages of using a virtual Visa card is that it allows you to shop economically. Unlike traditional credit cards, virtual Visa cards are not linked to your bank account. Instead, they are preloaded with a specific amount of money, which helps you stay within your budget. By setting a limit on your virtual Visa card, you can avoid overspending and impulse buying.

Furthermore, virtual Visa cards offer enhanced security features. When you make a purchase online, you don’t have to provide your personal credit card information. Instead, you can use your virtual Visa card, which acts as a shield between your sensitive data and potential hackers. This added layer of security ensures that your financial information remains safe and protected.

Another benefit of using a virtual Visa card is the ability to track your expenses easily. Most virtual Visa card providers offer detailed transaction histories, allowing you to monitor your spending habits. By reviewing your purchase history, you can identify areas where you may be overspending and make necessary adjustments to stay within your budget. This level of transparency empowers you to make informed decisions about your shopping habits.

Additionally, virtual Visa cards often come with exclusive discounts and offers. Many online retailers partner with virtual Visa card providers to offer special promotions to cardholders. By taking advantage of these discounts, you can save even more money on your purchases. Whether it’s free shipping, cashback rewards, or exclusive deals, virtual Visa cards can help you stretch your budget further.

Moreover, virtual Visa cards offer convenience and flexibility. You can easily load funds onto your virtual Visa card from your bank account or other sources. This eliminates the need to carry physical cash or multiple credit cards, making your shopping experience more streamlined. Additionally, virtual Visa cards can be used for online purchases worldwide, allowing you to shop from international retailers without any hassle.

In conclusion, using a virtual Visa card for budget-friendly shopping offers numerous benefits. From helping you stay within your budget to providing enhanced security features, virtual Visa cards are a valuable tool for online shoppers. By tracking your expenses, taking advantage of exclusive discounts, and enjoying the convenience and flexibility they offer, you can shop economically and make the most of your online shopping experience. So, the next time you’re looking to shop online, consider using a virtual Visa card to save money and shop with peace of mind.

Smart Strategies for Shopping Economically with a Virtual Visa Card

How to Shop Economically with Virtual Visa Card

In today’s digital age, online shopping has become increasingly popular. With just a few clicks, you can have your desired items delivered right to your doorstep. However, shopping online can sometimes be expensive, especially if you’re not careful. That’s where a virtual Visa card comes in handy. In this article, we will discuss smart strategies for shopping economically with a virtual Visa card.

First and foremost, it’s important to understand what a virtual Visa card is. Unlike a physical card, a virtual Visa card is a digital version that can be used for online purchases. It works just like a regular Visa card, but without the physical presence. This means that you can use it to shop online without worrying about carrying a physical card or exposing your personal information.

One of the key advantages of using a virtual Visa card is the added layer of security it provides. When you make a purchase online, you enter your virtual Visa card details instead of your actual credit card information. This helps protect your sensitive data from potential hackers or identity thieves. Additionally, some virtual Visa cards offer additional security features such as one-time use numbers or spending limits, further enhancing your online shopping safety.

Another benefit of using a virtual Visa card is the ability to track your expenses more efficiently. With a physical card, it’s easy to lose track of your spending, especially if you make frequent online purchases. However, with a virtual Visa card, you can easily monitor your transactions through online banking or mobile apps. This allows you to keep a close eye on your budget and avoid overspending.

When it comes to shopping economically with a virtual Visa card, there are a few strategies you can employ. First, take advantage of discounts and promotions. Many online retailers offer exclusive deals for virtual Visa cardholders. Keep an eye out for these offers and make sure to take advantage of them to save money on your purchases.

Additionally, consider using price comparison websites or apps to find the best deals. These platforms allow you to compare prices across different online retailers, ensuring that you get the best value for your money. By using a virtual Visa card, you can easily make secure payments on these platforms and enjoy the benefits of shopping economically.

Furthermore, consider using cashback or rewards programs offered by your virtual Visa card provider. Some virtual Visa cards offer cashback on certain purchases or reward points that can be redeemed for discounts or freebies. By taking advantage of these programs, you can further maximize your savings and make your shopping experience even more economical.

In conclusion, shopping online can be expensive, but with a virtual Visa card, you can shop economically and save money. By understanding the benefits of using a virtual Visa card, such as enhanced security and better expense tracking, you can make smart choices when it comes to online shopping. Remember to take advantage of discounts, compare prices, and utilize cashback or rewards programs to get the most out of your virtual Visa card. With these strategies in mind, you can shop with confidence and enjoy the convenience of online shopping without breaking the bank.

related blogs

How Do I Instant Virtual Credit Card ?

What is Foton Card Invitation Code?