Virtual Debit Card

Advantages of Using Virtual Debit Cards

In today’s digital age, virtual debit cards have become increasingly popular as a convenient and secure way to make online purchases. These virtual cards are essentially digital versions of traditional debit cards, allowing users to make transactions without the need for a physical card. There are several advantages to using virtual debit cards, making them a preferred choice for many consumers.

One of the main advantages of virtual debit cards is the added layer of security they provide. With traditional debit cards, there is always a risk of having your card information stolen or compromised. However, virtual debit cards are not tied to a physical card, making them less susceptible to fraud and unauthorized transactions. This added security can give users peace of mind when making online purchases, knowing that their financial information is protected.

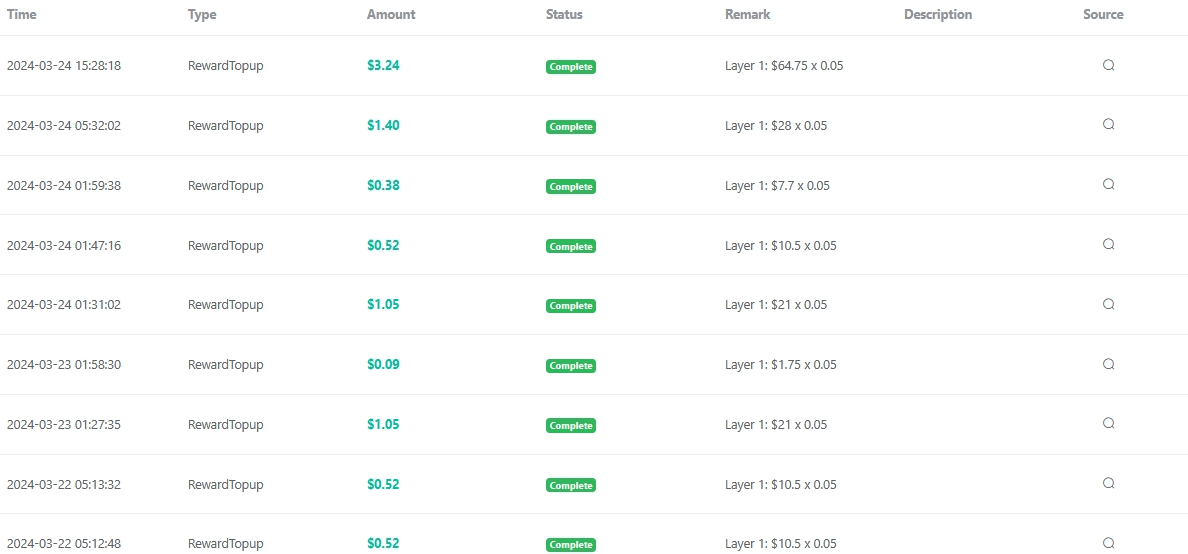

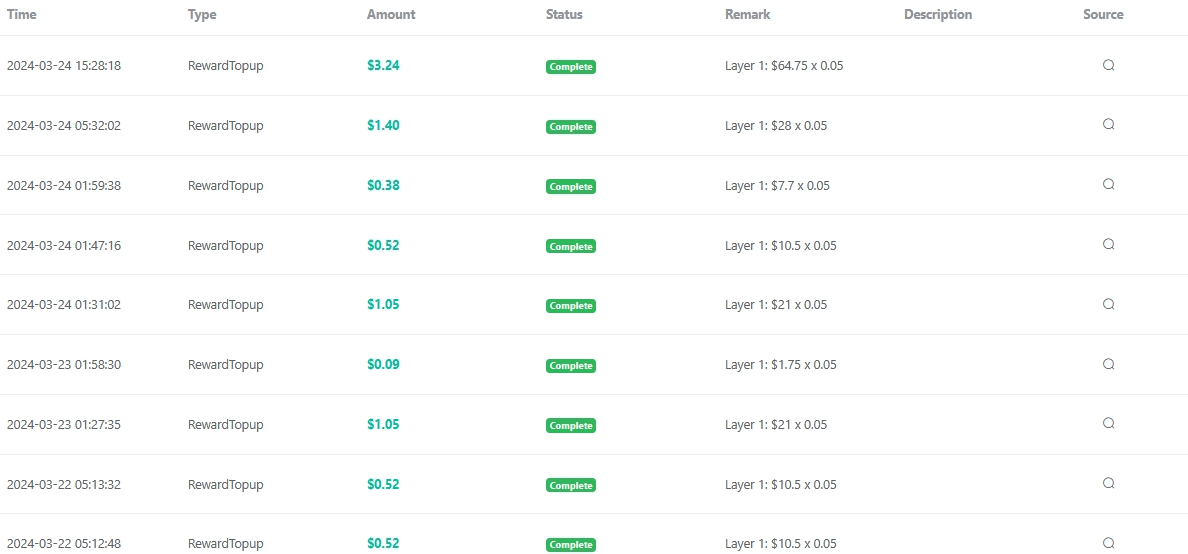

Another advantage of virtual debit cards is the ability to easily manage and track your spending. Virtual cards are typically linked to a specific account or budget, allowing users to set limits on how much they can spend. This can help users stay within their budget and avoid overspending. Additionally, virtual debit cards often come with features that allow users to track their transactions in real-time, giving them a clear picture of their spending habits.

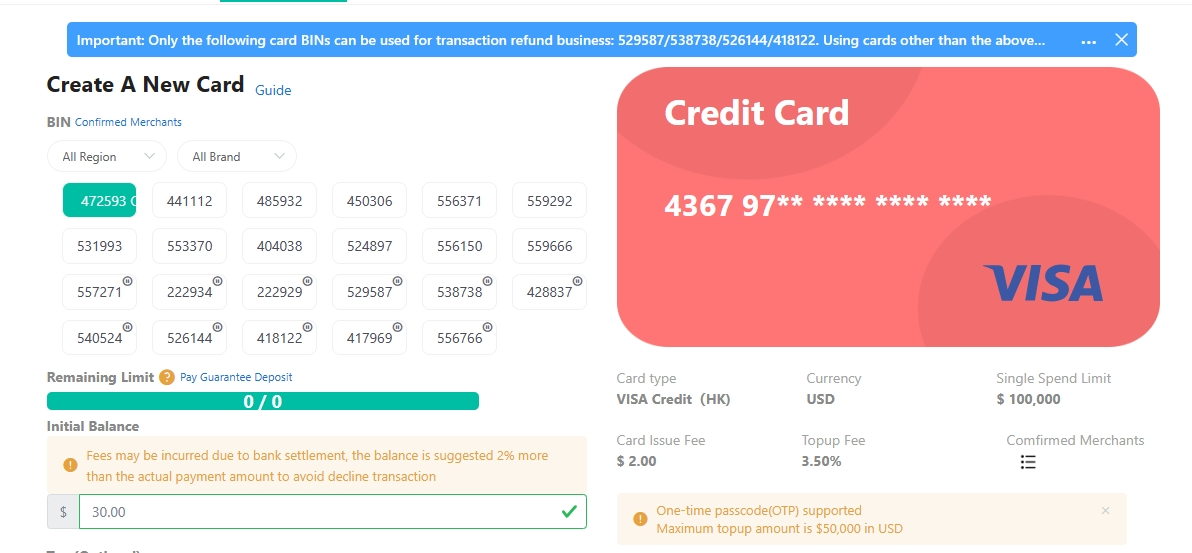

Virtual debit cards also offer greater flexibility and convenience compared to traditional debit cards. With a virtual card, users can make purchases online without having to enter their card information each time. This can save time and make the checkout process faster and more efficient. Additionally, virtual debit cards can be easily reloaded with funds, making them a convenient option for those who prefer not to carry cash or physical cards.

Furthermore, virtual debit cards are a great option for those who travel frequently or make purchases from international vendors. Virtual cards can be used for online purchases from anywhere in the world, making them a versatile payment option for global transactions. Additionally, virtual cards often come with competitive exchange rates, making them a cost-effective choice for international purchases.

In conclusion, virtual debit cards offer a range of advantages that make them a preferred choice for many consumers. From added security and easy tracking of spending to greater flexibility and convenience, virtual debit cards provide a convenient and secure way to make online purchases. Whether you are looking to protect your financial information, track your spending, or make international purchases, virtual debit cards offer a versatile and efficient payment option. Consider using a virtual debit card for your next online purchase and experience the benefits for yourself.

How to Safely Use Virtual Debit Cards for Online Transactions

In today’s digital age, online transactions have become a common way to make purchases and payments. With the rise of e-commerce, it is essential to ensure that your financial information is secure when making online transactions. One way to protect your financial information is by using a virtual debit card.

A virtual debit card is a digital version of a physical debit card that can be used for online transactions. It is linked to your bank account, just like a traditional debit card, but it does not have a physical form. Instead, it exists only in the digital realm, making it more secure than a physical card.

One of the main benefits of using a virtual debit card is that it adds an extra layer of security to your online transactions. Since it is not a physical card, it cannot be stolen or lost like a traditional debit card. This reduces the risk of unauthorized transactions and fraud.

Another advantage of using a virtual debit card is that it allows you to control your spending more effectively. You can set limits on how much money can be spent using the virtual card, which can help you stick to your budget and avoid overspending. Additionally, since the virtual card is not linked to your physical debit card, it can help protect your main bank account from potential fraud.

When using a virtual debit card for online transactions, it is important to follow some safety tips to ensure that your financial information remains secure. First and foremost, make sure to only use your virtual debit card on secure websites that have encryption technology in place. Look for the padlock symbol in the address bar of the website, which indicates that the site is secure.

It is also important to keep your virtual debit card information private and not share it with anyone. Treat your virtual card information with the same level of confidentiality as you would your physical debit card. Avoid storing your virtual card details on unsecured devices or sharing them over unsecured networks.

Additionally, regularly monitor your virtual debit card transactions to check for any unauthorized charges. Most banks and financial institutions offer online banking services that allow you to track your transactions in real-time. If you notice any suspicious activity on your virtual card, report it to your bank immediately.

In conclusion, virtual debit cards are a safe and convenient way to make online transactions. By following these safety tips and best practices, you can protect your financial information and enjoy the convenience of online shopping without worrying about fraud or unauthorized charges. Stay vigilant and proactive in monitoring your virtual debit card transactions to ensure a secure online shopping experience.

Comparing Different Virtual Debit Card Providers

Virtual debit cards have become increasingly popular in recent years as a convenient and secure way to make online purchases. These cards are linked to your existing bank account but provide an added layer of security by generating a unique card number for each transaction. There are several virtual debit card providers on the market, each offering different features and benefits. In this article, we will compare some of the top virtual debit card providers to help you choose the best option for your needs.

One of the most well-known virtual debit card providers is Privacy.com. Privacy.com allows users to create virtual cards for online purchases, subscriptions, and recurring payments. Users can set spending limits, freeze cards, and even create single-use cards for added security. Privacy.com also offers a browser extension that automatically fills in card information at checkout, making online shopping even more convenient.

Another popular virtual debit card provider is Revolut. Revolut offers a range of financial services, including virtual debit cards that can be used for online and in-store purchases. Revolut’s virtual cards come with real-time spending notifications, budgeting tools, and the ability to freeze and unfreeze cards instantly. Revolut also offers a premium subscription that includes additional features such as travel insurance and cryptocurrency trading.

A newer player in the virtual debit card market is DoNotPay. DoNotPay’s virtual debit cards are designed to help users avoid free trials that automatically convert to paid subscriptions. Users can create virtual cards with spending limits and expiration dates to prevent unauthorized charges. DoNotPay also offers a virtual credit card option that allows users to build credit history without the risk of overspending.

When comparing virtual debit card providers, it’s important to consider factors such as fees, security features, and ease of use. Privacy.com offers a free basic plan with limited features, as well as a paid premium plan with additional benefits. Revolut charges a monthly fee for its premium subscription, but the basic virtual card service is free to use. DoNotPay’s virtual debit cards are free to create and use, making them a cost-effective option for budget-conscious consumers.

In terms of security features, all three virtual debit card providers offer encryption and fraud protection to keep your financial information safe. Privacy.com’s single-use cards and spending limits provide an extra layer of security, while Revolut’s real-time notifications help users monitor their transactions for any suspicious activity. DoNotPay’s virtual cards with expiration dates help prevent unauthorized charges and protect users from unwanted subscriptions.

When it comes to ease of use, Privacy.com’s browser extension makes online shopping quick and convenient, while Revolut’s budgeting tools help users track their spending and stay on top of their finances. DoNotPay’s user-friendly interface makes it easy to create and manage virtual cards, making it a great option for those new to virtual debit cards.

In conclusion, virtual debit cards are a convenient and secure way to make online purchases. When comparing different virtual debit card providers, consider factors such as fees, security features, and ease of use to choose the best option for your needs. Whether you choose Privacy.com, Revolut, or DoNotPay, you can rest assured that your financial information is safe and secure when using a virtual debit card for online transactions.

related blogs

How Do I Instant Virtual Credit Card ?

What is Foton Card Invitation Code?