How to Issue a Virtual Visa Card

Step-by-Step Guide: How to Issue a Virtual Visa Card

How to Issue a Virtual Visa Card

In today’s digital age, virtual payment methods have become increasingly popular. One such method is the virtual Visa card, which allows users to make online purchases without the need for a physical card. If you’re interested in issuing a virtual Visa card, this step-by-step guide will walk you through the process.

Firstly, it’s important to understand what a virtual Visa card is. Unlike a traditional Visa card, which is made of plastic and can be physically swiped or inserted into a card reader, a virtual Visa card exists solely in the digital realm. It consists of a unique 16-digit card number, an expiration date, and a security code, just like a physical card.

To issue a virtual Visa card, you’ll need to have an account with a financial institution that offers this service. Many banks and online payment platforms provide virtual Visa cards as part of their offerings. Once you’ve identified a suitable provider, follow these steps to issue your virtual Visa card.

Step 1: Log in to your account

Start by logging in to your account on the financial institution’s website or mobile app. If you don’t have an account yet, you’ll need to sign up and provide the necessary personal information.

Step 2: Navigate to the virtual card section

Once you’re logged in, navigate to the section of the website or app that deals with virtual cards. This may be labeled as “Virtual Cards,” “Digital Cards,” or something similar. If you’re having trouble finding it, consult the platform’s help section or contact customer support.

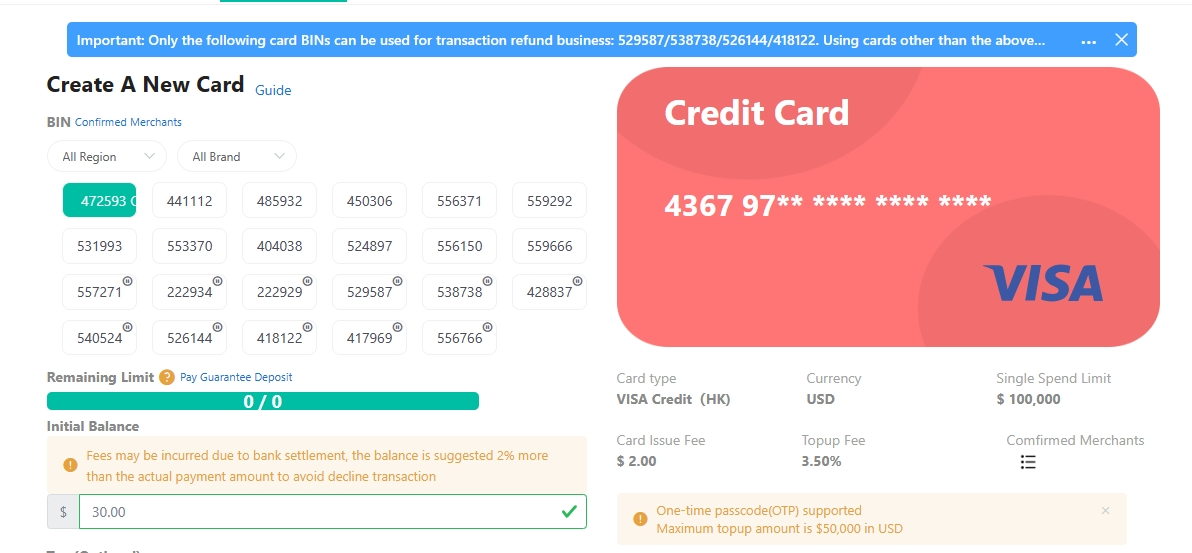

Step 3: Choose the type of virtual Visa card

Next, you’ll need to select the type of virtual Visa card you want to issue. Some providers offer different options, such as prepaid or reloadable cards. Consider your needs and preferences before making a decision.

Step 4: Enter the required details

After selecting the type of virtual Visa card, you’ll be prompted to enter the necessary details. This typically includes your name, billing address, and email address. Make sure to double-check the information for accuracy.

Step 5: Set spending limits and restrictions

Depending on the provider, you may have the option to set spending limits and restrictions for your virtual Visa card. This can be useful for controlling your expenses or ensuring that the card can only be used for specific purposes.

Step 6: Verify your identity

To ensure the security of your virtual Visa card, you may be required to verify your identity. This can be done through various methods, such as providing additional identification documents or answering security questions.

Step 7: Review and confirm

Before issuing your virtual Visa card, take a moment to review all the information you’ve entered. Make sure everything is correct and to your satisfaction. Once you’re confident, click the “Confirm” or “Issue Card” button to complete the process.

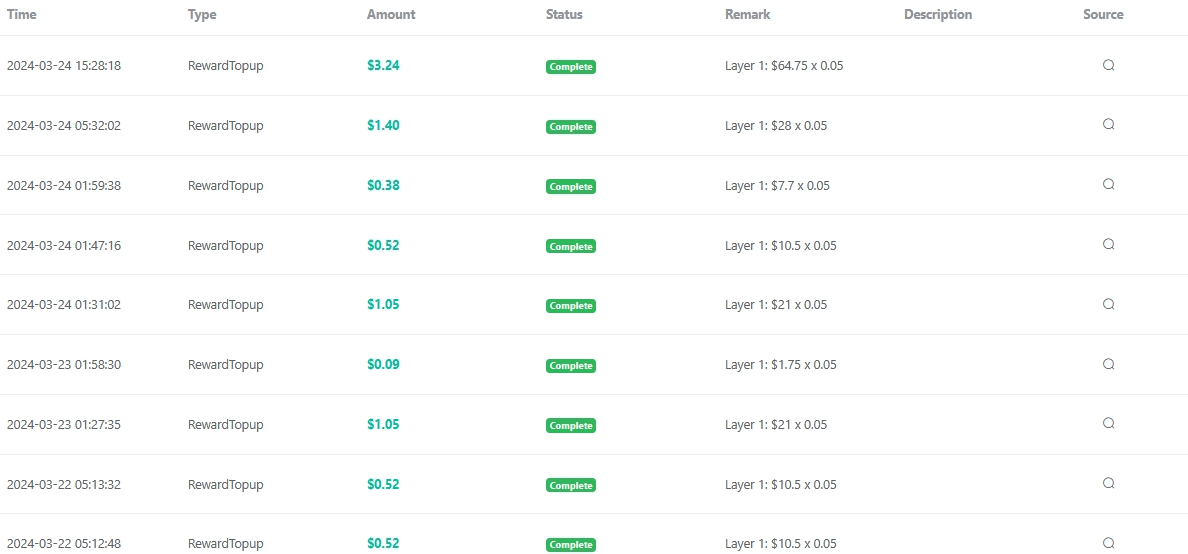

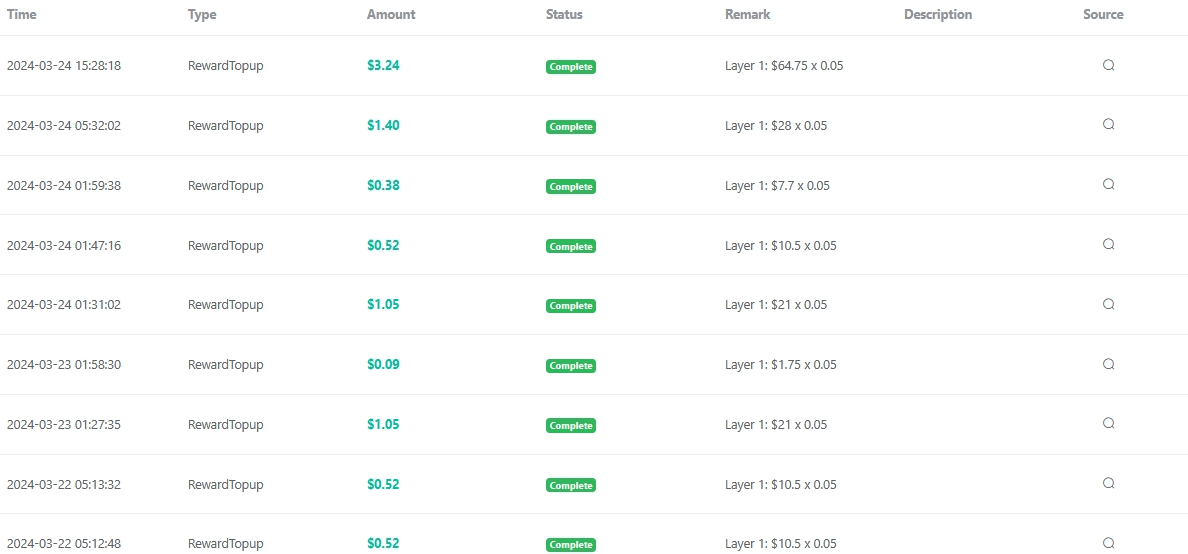

Congratulations! You’ve successfully issued a virtual Visa card. You can now use this card for online purchases, just like you would with a physical Visa card. Remember to keep your card details secure and monitor your transactions regularly for any unauthorized activity.

In conclusion, issuing a virtual Visa card is a straightforward process that can be done through your financial institution’s website or mobile app. By following these step-by-step instructions, you’ll be able to enjoy the convenience and security of virtual payments in no time.

Benefits and Features of Virtual Visa Cards: A Comprehensive Overview

How to Shop Economically with Virtual Visa Card

Virtual Visa cards have become increasingly popular in recent years, offering a convenient and secure way to make online purchases. These virtual cards function just like physical Visa cards, but without the need for a physical card to be issued. In this article, we will explore the benefits and features of virtual Visa cards, providing a comprehensive overview of this innovative payment solution.

One of the key advantages of virtual Visa cards is their ease of use. Unlike traditional credit or debit cards, which require a physical presence, virtual Visa cards can be issued and used entirely online. This means that you can apply for and receive a virtual Visa card without ever leaving the comfort of your own home. This convenience is particularly appealing for those who prefer to do their shopping online or who frequently travel and need a reliable payment method.

Another significant benefit of virtual Visa cards is their enhanced security features. With traditional cards, there is always a risk of theft or loss, which can lead to unauthorized transactions and potential financial loss. Virtual Visa cards eliminate this risk by providing a unique card number and CVV code for each transaction. This means that even if your virtual Visa card details are compromised, the thief would only have access to a limited amount of funds, reducing the potential damage.

Furthermore, virtual Visa cards offer greater control over your spending. With a traditional credit or debit card, it can be easy to overspend or lose track of your expenses. Virtual Visa cards allow you to set a specific spending limit, ensuring that you stay within your budget. Additionally, some virtual Visa card providers offer real-time transaction notifications, allowing you to monitor your spending and detect any suspicious activity immediately.

Virtual Visa cards also offer a high level of flexibility. They can be used for a wide range of online purchases, including subscriptions, digital downloads, and even booking flights and accommodations. This versatility makes virtual Visa cards an ideal payment solution for individuals who frequently engage in online transactions.

In addition to these benefits, virtual Visa cards often come with additional features that enhance the overall user experience. For example, some virtual Visa card providers offer rewards programs, allowing you to earn points or cashback on your purchases. These rewards can be redeemed for various perks, such as discounts on future purchases or even gift cards.

To issue a virtual Visa card, the process is typically straightforward. You will need to find a reputable virtual Visa card provider and complete their online application form. This form will require you to provide personal information, such as your name, address, and contact details. Once your application is approved, you will receive your virtual Visa card details via email or through the provider’s mobile app.

In conclusion, virtual Visa cards offer numerous benefits and features that make them an attractive payment solution for online purchases. Their ease of use, enhanced security, spending control, and flexibility make them a convenient and reliable option for individuals who prefer to shop online or frequently travel. Additionally, the additional features, such as rewards programs, further enhance the overall user experience. If you are looking for a secure and convenient way to make online purchases, consider issuing a virtual Visa card.

Top Virtual Visa Card Providers: A Comparison and Review

Virtual Visa cards have become increasingly popular in recent years, offering a convenient and secure way to make online purchases. These virtual cards function just like physical Visa cards, but without the need for a physical card. Instead, they exist solely in the digital realm, making them ideal for online shopping and other digital transactions. In this article, we will compare and review some of the top virtual Visa card providers, helping you choose the best option for your needs.

One of the leading virtual Visa card providers is Payoneer. Payoneer offers a simple and straightforward process for issuing virtual Visa cards. To get started, you need to create a Payoneer account and provide the necessary personal and financial information. Once your account is set up, you can easily issue a virtual Visa card by selecting the option in your account dashboard. Payoneer also offers additional features such as the ability to link your virtual card to your PayPal account, making it even more versatile.

Another popular virtual Visa card provider is Entropay. Entropay allows you to create virtual Visa cards instantly, without the need for a credit check or bank account. Simply sign up for an Entropay account, add funds to your virtual card, and you’re ready to go. Entropay also offers a mobile app, making it easy to manage your virtual cards on the go. However, it’s worth noting that Entropay charges fees for certain transactions, so be sure to review their fee structure before using their services.

If you’re looking for a virtual Visa card provider with a global reach, then Neteller might be the right choice for you. Neteller offers virtual Visa cards that can be used in over 200 countries, making it a great option for international transactions. To issue a virtual Visa card with Neteller, you need to create an account and verify your identity. Once your account is set up, you can easily generate virtual cards and manage them through the Neteller website or mobile app. Neteller also offers additional features such as the ability to withdraw funds from your virtual card to your bank account.

Lastly, we have Revolut, a virtual Visa card provider that offers a range of additional features and benefits. Revolut allows you to create virtual Visa cards instantly through their mobile app, making it incredibly convenient. In addition to virtual cards, Revolut also offers physical cards that can be used for in-store purchases. One unique feature of Revolut is their ability to convert currencies at the interbank exchange rate, making it a great option for frequent travelers or those who frequently make international purchases. However, it’s worth noting that Revolut charges fees for certain transactions, so be sure to review their fee structure before using their services.

In conclusion, virtual Visa cards offer a convenient and secure way to make online purchases. Whether you choose Payoneer, Entropay, Neteller, or Revolut, each of these virtual Visa card providers offers its own unique features and benefits. By comparing and reviewing these providers, you can choose the one that best suits your needs and preferences. So, why wait? Start issuing your virtual Visa card today and enjoy the convenience and security it offers for your online transactions.

related blogs

How Do I Instant Virtual Credit Card ?

What is Foton Card Invitation Code?