What an instant Approval Virtual Credit Card

Benefits of Using an Instant Approval Virtual Credit Card

In today’s digital age, the use of credit cards has become increasingly popular for making online purchases. With the rise of e-commerce platforms and online shopping, having a credit card has become a necessity for many consumers. However, traditional credit cards come with their own set of limitations and risks. This is where instant approval virtual credit cards come in.

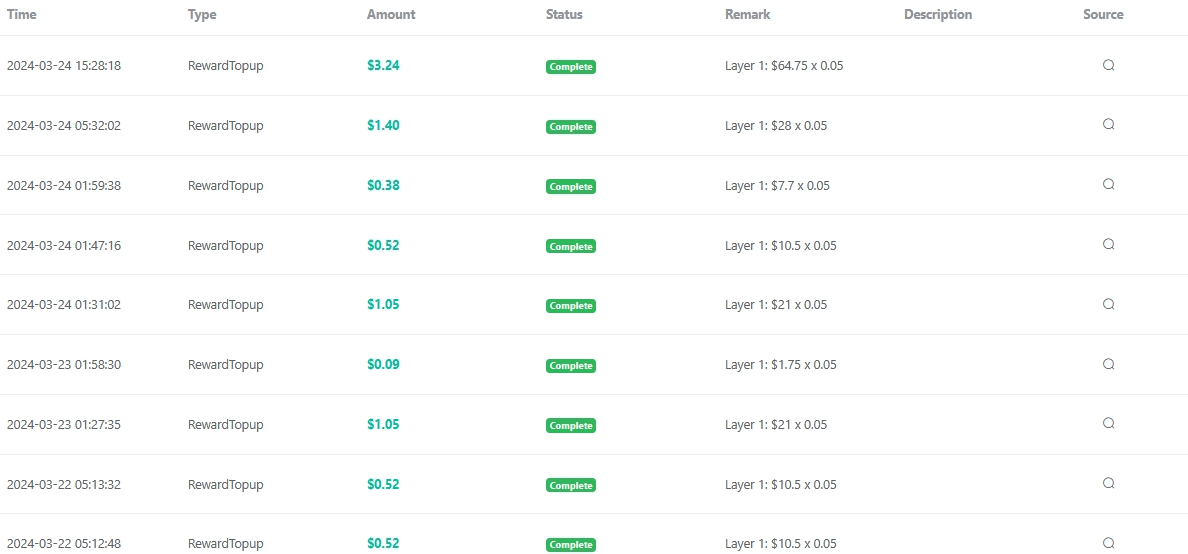

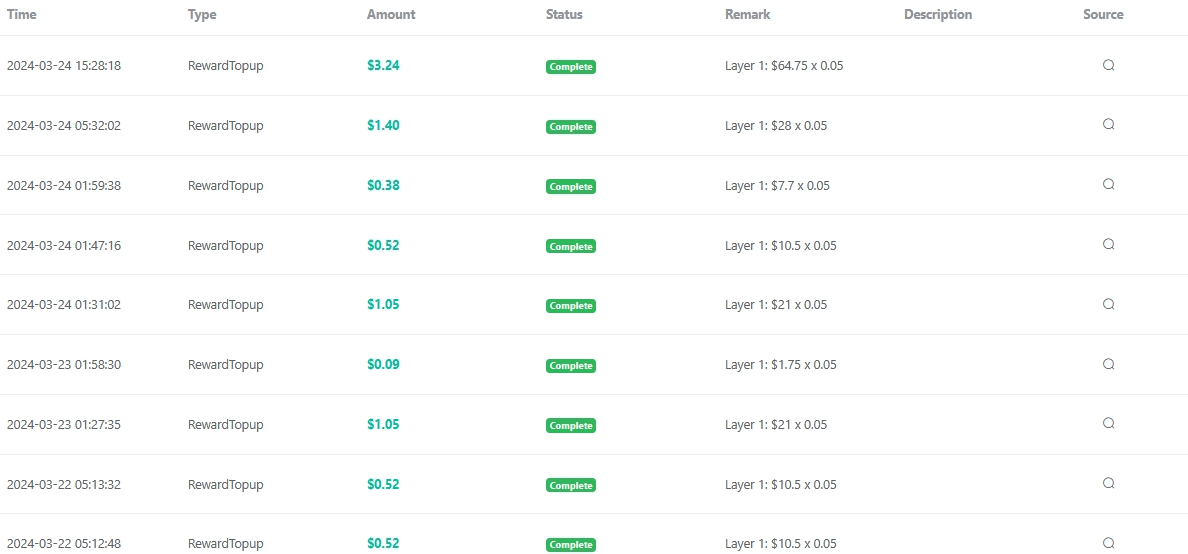

Instant approval virtual credit cards are a convenient and secure alternative to traditional credit cards. These virtual cards are issued instantly upon approval, allowing users to make online purchases without having to wait for a physical card to arrive in the mail. This instant approval process makes virtual credit cards an attractive option for those who need to make online purchases quickly and securely.

One of the key benefits of using an instant approval virtual credit card is the added layer of security it provides. Virtual credit cards are designed to be used for a single transaction or for a limited time period, reducing the risk of fraud and unauthorized charges. Since virtual credit cards are not tied to a physical card, they are less susceptible to theft or loss. This added security feature gives users peace of mind when making online purchases, knowing that their financial information is protected.

Another benefit of using an instant approval virtual credit card is the flexibility it offers. Virtual credit cards can be easily generated and used for specific purchases, such as subscriptions or online services. Users can set spending limits and expiration dates for each virtual card, giving them greater control over their finances. This flexibility allows users to manage their expenses more effectively and avoid overspending.

Additionally, instant approval virtual credit cards are a great option for those who have a limited credit history or poor credit score. Since virtual credit cards are not tied to a physical card, they are easier to obtain and do not require a credit check. This makes virtual credit cards a viable option for individuals who may have difficulty getting approved for a traditional credit card.

Furthermore, instant approval virtual credit cards offer convenience and ease of use. Users can easily generate virtual cards through their online banking portal or mobile app, making it quick and simple to make online purchases. Virtual credit cards can also be used for recurring payments, such as monthly subscriptions or utility bills, saving users time and hassle.

In conclusion, instant approval virtual credit cards offer a range of benefits for consumers looking for a secure and convenient way to make online purchases. From added security and flexibility to ease of use and accessibility, virtual credit cards provide a practical solution for managing finances in today’s digital world. Whether you are looking to protect your financial information, control your spending, or simply make online purchases more efficiently, an instant approval virtual credit card may be the right choice for you.

How to Apply for an Instant Approval Virtual Credit Card

In today’s digital age, virtual credit cards have become increasingly popular due to their convenience and security features. One type of virtual credit card that has gained traction is the instant approval virtual credit card. This type of credit card allows users to apply for and receive approval in a matter of minutes, making it a quick and easy option for those in need of immediate purchasing power.

To apply for an instant approval virtual credit card, the process is typically straightforward and can be completed online. The first step is to choose a reputable financial institution or credit card provider that offers instant approval virtual credit cards. It is important to research and compare different options to find the best fit for your financial needs and preferences.

Once you have selected a provider, you will need to fill out an online application form. This form will typically require you to provide personal information such as your name, address, social security number, and income details. It is important to ensure that all information provided is accurate and up to date to increase your chances of approval.

After submitting your application, the financial institution will review your information and make a decision on your credit card application. With instant approval virtual credit cards, the approval process is typically quick, and you will receive a response within minutes. If approved, you will be provided with a virtual credit card number that can be used for online purchases immediately.

One of the key benefits of instant approval virtual credit cards is the speed at which you can receive approval and start using your credit card. This can be particularly useful in situations where you need to make a purchase quickly or do not have time to wait for a traditional credit card application to be processed.

In addition to the convenience of instant approval, virtual credit cards also offer enhanced security features that can help protect your personal and financial information. Virtual credit cards are typically single-use or limited-use cards, meaning that they can only be used for a specific transaction or within a certain time frame. This can help prevent unauthorized transactions and reduce the risk of fraud.

Furthermore, virtual credit cards do not require a physical card to be issued, making them a more environmentally friendly option compared to traditional credit cards. This can also be beneficial for those who prefer to manage their finances digitally and reduce the clutter of physical cards.

Overall, instant approval virtual credit cards offer a quick and convenient way to access credit for online purchases. By following the steps outlined above and choosing a reputable provider, you can apply for and receive approval for a virtual credit card in a matter of minutes. With enhanced security features and the ability to use the card immediately, instant approval virtual credit cards are a practical and efficient option for those in need of fast purchasing power.

Top Providers of Instant Approval Virtual Credit Cards

In today’s digital age, virtual credit cards have become increasingly popular for their convenience and security features. One type of virtual credit card that has gained traction in recent years is the instant approval virtual credit card. These cards offer users the ability to quickly apply for and receive a virtual credit card without the need for a lengthy approval process.

Instant approval virtual credit cards are a great option for those who need a credit card quickly, whether it be for online shopping, travel, or other expenses. These cards can be used just like a traditional credit card, but without the physical card itself. Instead, users are provided with a virtual card number, expiration date, and security code that can be used for online purchases.

There are several top providers of instant approval virtual credit cards that offer a variety of features and benefits. One such provider is Netspend, which offers a virtual credit card that can be used for online purchases and bill payments. Netspend’s virtual credit card is easy to apply for and can be used immediately upon approval.

Another top provider of instant approval virtual credit cards is Capital One. Capital One offers a virtual credit card that can be used for online purchases and provides users with fraud protection and security features. Capital One’s virtual credit card is a great option for those looking for a secure and convenient way to make online purchases.

PayPal is also a top provider of instant approval virtual credit cards. PayPal offers a virtual credit card that can be used for online purchases and provides users with the ability to link their virtual card to their PayPal account for added convenience. PayPal’s virtual credit card is a popular choice for those who frequently shop online and want a secure payment option.

In addition to these top providers, there are several other companies that offer instant approval virtual credit cards, each with their own unique features and benefits. Some providers offer rewards programs, cash back incentives, and other perks for using their virtual credit cards.

When choosing an instant approval virtual credit card, it’s important to consider the fees, interest rates, and terms and conditions associated with the card. Some providers may charge annual fees or have higher interest rates than others, so it’s important to compare options before making a decision.

Overall, instant approval virtual credit cards are a convenient and secure way to make online purchases and manage expenses. With top providers like Netspend, Capital One, and PayPal offering virtual credit cards with instant approval, users have plenty of options to choose from. Whether you’re looking for a secure payment option for online shopping or need a quick way to make purchases while traveling, an instant approval virtual credit card may be the right choice for you.

related blogs

How Do I Instant Virtual Credit Card ?

What is Foton Card Invitation Code?